A Complete Guide to Commission Splits, Caps, and Fees at REAL Broker (2025)

Complete Guide to Commission Splits, Caps, and Fees at REAL Broker

For real estate agents, selecting the right brokerage often comes down to understanding the financial structure of commission splits, caps, and fees. REAL Broker is attracting agents nationwide with a structure that prioritizes competitive commission splits, a low annual cap, and minimal fees—all designed to maximize agents' profitability.

This guide will break down each element, showing why REAL Broker’s approach is ideal for agents looking to build their earnings efficiently.

REAL Broker’s Competitive Commission Split

Overview of the 85/15 Commission Split

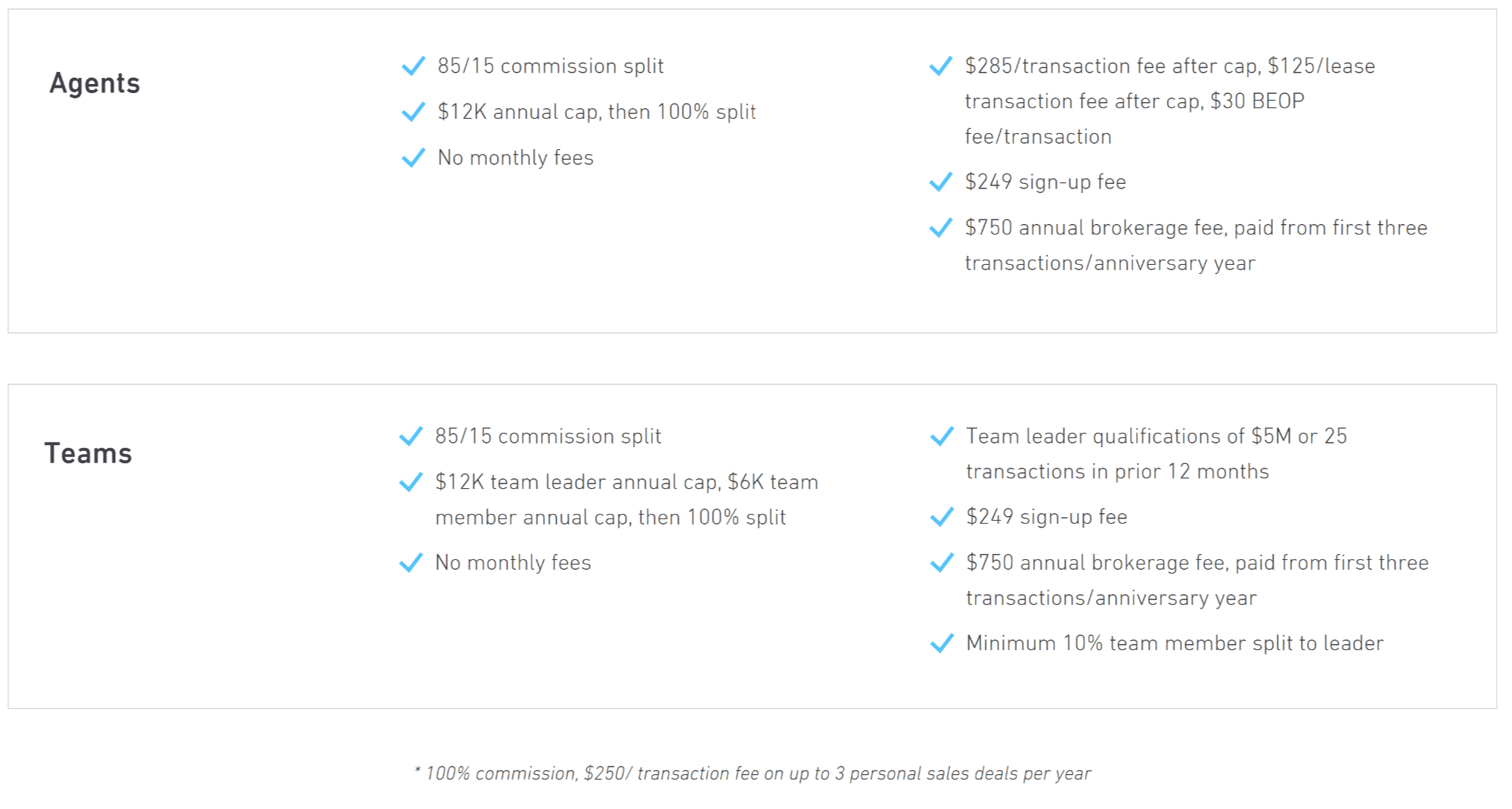

REAL Broker offers an 85/15 commission split, meaning agents retain 85% of each transaction’s commission, while only 15% goes to the brokerage. This setup is a significant advantage for agents who prioritize high take-home earnings and is especially beneficial for those handling frequent or high-value transactions.

The 85/15 split is designed to let agents keep the bulk of their income, empowering them to build wealth without excessive deductions from each transaction. Compared to traditional splits that can range from 60/40 to 70/30, REAL Broker’s split allows agents to earn more while still benefiting from a supportive brokerage model.

Why an 85/15 Split Benefits Agents

The 85/15 commission split means that agents take home a larger portion of each sale, which directly boosts their earnings. In an industry where every transaction counts, having a high split puts more income in agents' pockets. This structure is especially advantageous for agents who close multiple deals each year, as the cumulative effect of keeping 85% becomes significant.

In many brokerages, agents are required to sacrifice larger portions of their commission, but at REAL Broker, agents can maximize their profitability without sacrificing support or resources.

The Annual Commission Cap at REAL Broker

How the $12,000 Cap Works

One of the most compelling aspects of REAL Broker’s model is its $12,000 annual commission cap. This means that after an agent pays $12,000 in commissions to the brokerage within a year, they then keep 100% of their commission for the rest of the year. This cap incentivizes agents to perform at high levels, knowing that once they reach the cap, they will retain every dollar they earn.

For example, if an agent hits the $12,000 cap by mid-year, they will receive all future commissions for the remainder of the year, without any further brokerage deductions. This setup effectively allows high-performing agents to maximize their earnings without ongoing commission splits.

Benefits of a Low Commission Cap

The low commission cap at REAL Broker benefits agents by letting them reach a full commission-retention threshold quickly, especially in high-sales markets. Once agents hit the cap, they operate with complete commission retention, which can significantly boost their year-end earnings.

Compared to brokerages with higher caps, REAL Broker’s $12,000 limit offers agents a better financial return on their hard work. Agents who want to build long-term wealth appreciate how quickly they can stop contributing a split to the brokerage and keep all their earnings.

How the Cap Structure Supports High-Earning Agents

For high-performing agents, the cap structure is exceptionally beneficial. It allows them to keep more of their earnings while maintaining access to REAL Broker’s resources. Agents with multiple deals each month can reach the cap early, maximizing profitability for the majority of the year. REAL Broker’s cap structure is designed to support agents' growth and incentivize high sales volumes, making it an excellent option for top producers.

REAL Broker’s Minimal Fees

Overview of Transaction Fees Post-Cap

Once agents hit the $12,000 commission cap, they are subject to minimal transaction fees on each subsequent deal. These fees are nominal compared to traditional brokerages and allow agents to continue profiting from their efforts without excessive deductions. The minimal transaction fees after the cap further reinforce REAL Broker’s commitment to helping agents retain as much of their earnings as possible.

Other Standard Fees and Deductions

Like most brokerages, REAL Broker has standard fees to cover essentials, such as Errors and Omissions (E&O) insurance. However, these fees are kept low and are transparently communicated to agents upfront. With fewer surprise deductions, agents can manage their earnings more predictably.

Comparison to Traditional Broker Fees

REAL Broker’s fees are minimal when compared to those at traditional brokerages. Many brokerages have administrative fees, desk fees, or technology fees, which can add up quickly. At REAL Broker, the low and transparent fee structure ensures that agents aren’t faced with unexpected costs, allowing them to manage a larger share of their earnings.

Why REAL Broker’s Commission Model Stands Out

Competitive Earnings and Wealth-Building Opportunities

REAL Broker’s commission model stands out by offering agents competitive earnings and multiple wealth-building opportunities. The high commission split, low annual cap, and minimal fees mean that agents can maximize their take-home pay while having additional ways to grow wealth through stock awards and revenue sharing.

The brokerage’s commitment to helping agents build long-term wealth is clear in the design of these financial incentives, making it an ideal choice for agents looking for a brokerage that aligns with their financial goals.

Cost-Effective Structure for Agents at All Levels

REAL Broker’s financial structure is designed to support agents at every stage of their career. New agents benefit from a generous split and low cap as they grow their business, while experienced agents and top producers enjoy the benefits of full commission retention and wealth-building opportunities. The cost-effective model allows agents to thrive without the burden of excessive fees, making REAL Broker a flexible and supportive environment for agents of all levels.

Ready to Maximize Your Earnings with REAL Broker?

REAL Broker’s commission splits, caps, and fees provide a clear advantage for agents looking to increase their earnings and build long-term wealth. With a generous 85/15 commission split, a low $12,000 cap, and minimal fees, REAL Broker offers an agent-friendly financial structure that sets it apart from traditional brokerages.

If you’re ready to elevate your real estate career and maximize your income potential, contact Rich Ayers below today to learn more about joining this dynamic brokerage. With REAL Broker, you can keep more of what you earn, build a sustainable career, and benefit from a brokerage that puts agents first.

Categories

Recent Posts

GET MORE INFORMATION

Rich Ayers

Team Lead | Realtor | License ID: 471.001732

Team Lead | Realtor License ID: 471.001732